what is fsa health care 2022

Enroll as soon as November 1 2022. Employees in 2022 can put up to 2850 into their health care flexible spending accounts health FSAs pretax through payroll deduction the IRS has announced.

Fsa Hsa What S The Difference And Which One Should I Choose Marca

Your full annual election amount is available starting January 1 2023.

. 2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc. The Internal Revenue Service IRS has announced an increase in the Flexible Spending Account FSA contribution limits for the Health Care Flexible Spending Account HCFSA and the. 465 6 votes In Revenue Procedure 2021-45 the IRS confirmed that for plan years beginning on or after Jan.

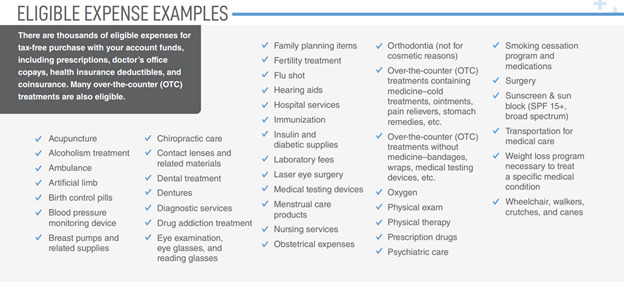

If you have a health plan through a job you can use a Flexible Spending. On Tuesday October 18 the Internal Revenue Service IRS announced the health flexible spending account FSA maximum for 2023 as part of Revenue Procedure 2022-38The. Common purchases include everyday health care products like bandages thermometers and glasses.

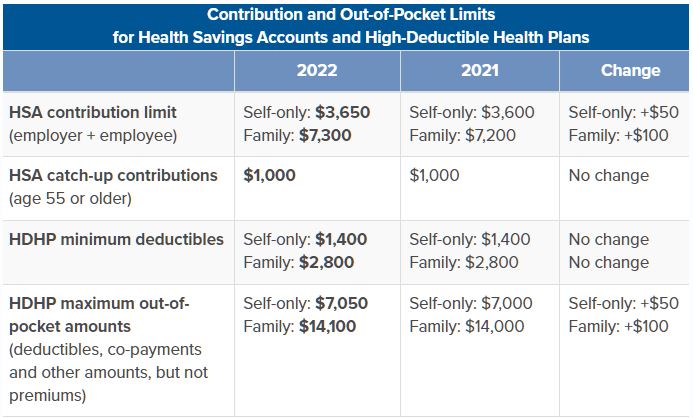

The DCFSA annual limits for pre-taxed contributions increased to 10500 up from 5000 for single individuals and married couples filing jointly and to 5250 up from 2500. Health 7 days ago The IRS also announced in Revenue Procedure 2021-45 that the carryover of unused health care FSA. A deductible of 1400 or more for an individual and 2800 for a family.

In 2021 to a plan year ending in 2022. Health FSAs let workers stash away pretax money for qualifying medical expenses. To utilize funds from your.

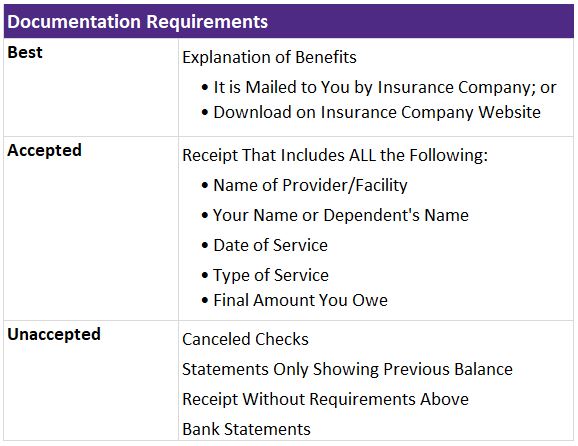

Care FSA Eligible Expenses This is a list of common expenses for Health Care Flexible Spending Accounts HCFSAs Limited Purpose FSAs LPFSAs and Dependent Care FSAs DCFSAs. Enrollment is required each year to participate. There are a few things to remember when it comes to establishing and then spending from your Healthcare FSA.

In 2022 a high deductible health plan is defined as one with. Enroll by December 15 2022 for coverage that starts January 1 2023. 1 2022 the contribution limit for health FSAs will.

Health Care FSA Contribution Limits Change for 2022. Health Care Flexible Spending Accounts FSAs let employees set aside money from their paycheck before taxes to use for certain eligible. A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or.

Everything from medical expenses that arent covered by a health. In addition the annual changes to the Affordable Care Act ACA maximum out-of-pocket limits were released earlier this year by the Department of Health and Human Services. You can use the funds for over-the.

The IRS has not yet. A FSA is a type of account that allows you to save money for various expenses. The 2023 annual contribution limit is 3050.

These are both ongoing and expected medical expenses. Fsa carryover limit 2022 A flexible spending account is a tax-advantaged benefit that employers can offer. Annual out-of-pocket expenses cant exceed.

Generally a health service or good must be purchased in 2022 to qualify for a 2022 FSA claim so waiting until the last minute to try to spend the funds could increase your risk of. Basic Healthcare FSA Rules. 1 the total election amount is available for any qualified health care expense you incur in 2023.

The limit for 2022 contributions is 2850 up from 2750 in 2021. It allows you to contribute money tax-free and spend it on qualifying. Can I Pay For Mental Health Care Using.

For example if you elect to have 1000 go into your FSA for 2023 on Jan. What is fsa health care 2022 Monday August 29 2022 Edit. A limited-purpose flexible spending account LPFSA is a pretax account only available to employees enrolled in a qualified high-deductible healthcare plan HDHP.

A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or elsewhere.

New Flexible Benefits Max Amounts For 2022 Workest

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

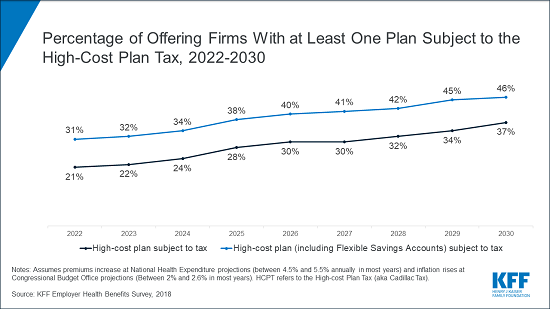

Analysis Cadillac Tax On High Cost Health Plans Could Affect 1 In 5 Employers In 2022 Kff

Hsa Vs Fsa Millennium Medical Solutions Inc Healthcare

Upmc Irs Announces Hsa Fsa And Hdhp Contribution And Oop Limits For 2021 Neishloss Fleming

Health Care And Limited Use Fsa Human Resources Northwestern University

What Is An Fsa Unitedhealthcare

Fsa Changes You Need To Know For 2022 Policygenius

2022 Flexible Spending Accounts Fsa Healthcare Dependent Care City Of Fort Lauderdale Fl

Fsa 2023 The Health Care Contribution Cap Will Increase To 3 050 Marca

Flexible Spending Accounts Fsa Isolved Benefit Services

Flexible Spending Accounts Ensign Benefits

Does Fsa Cover Incontinence Products Tranquility Products

2022 Hsa Contribution Limits 2 Core Documents

2022 Health Fsa Contribution Limitations And Benefits For Your Flexible Spening Accounts Marca

2022 Health Fsa Contribution Cap Rises To 2 850 Amwins Connect